What is payroll giving?

Payroll giving is a way for your employees to make regular donations to charity directly from their pay. This means employees get tax relief on their donation immediately, at their highest tax rate. People who receive their company/personal through PAYE (Pay As You Earn) can participate too.

Business benefits:

- Employee engagement: payroll giving is an employee benefit and your commitment to empowering your employees to support the causes they care about

- Enhances your community programme:payroll giving can be used as a great tool or platform to drive your wider community initiatives, helping to build donations to your chosen charity via a campaign

- Stand out from the crowd: like any employee benefit this reflects on your company culture and is a differentiator when recruiting staff. The Payroll Giving Quality Mark gives you an accreditation to showcase your commitment

Charity benefits:

- Payroll giving provides charities with regular, reliable donations that allow them to plan ahead and budget for the future. By signing up to payroll giving, you can generate a vital, unrestricted income stream for UK charities. Payroll giving provides over £160,000,000 to charities every year

Employee benefits:

- Payroll giving is an easy, tax-efficient way to give to charity – it costs employees less to give more. The system is easy to opt in and out of, giving donors full control over their giving

How to set up a payroll giving scheme for your business

1) Choose an agency

You’ll need to choose a payroll giving agency to administer your payroll giving – here’s an HMRC approved list of them. There’s also an Association of Payroll Giving Providers which has its own code of conduct that members must adhere to.

Agencies will charge different administration fees (often a % of the donation) to process payroll giving for you, and will offer different benefits such as online platform, prepared comms to help you promote it and data on how much has been donated in total. If you’re not sure which agency to go with, you could ask colleagues in similar businesses for their recommendations.

The administration fees can either be deducted from the amount the charities receive, or you can choose to pay it yourself, so the charity gets the whole amount of your employee’s donation. If you do this, you can set whatever you pay against your profits for tax purposes.

Your own administration costs should be very low. Once giving is set up in your payroll system it becomes routine procedure. Any extra costs incurred can be set against your profits for tax purposes.

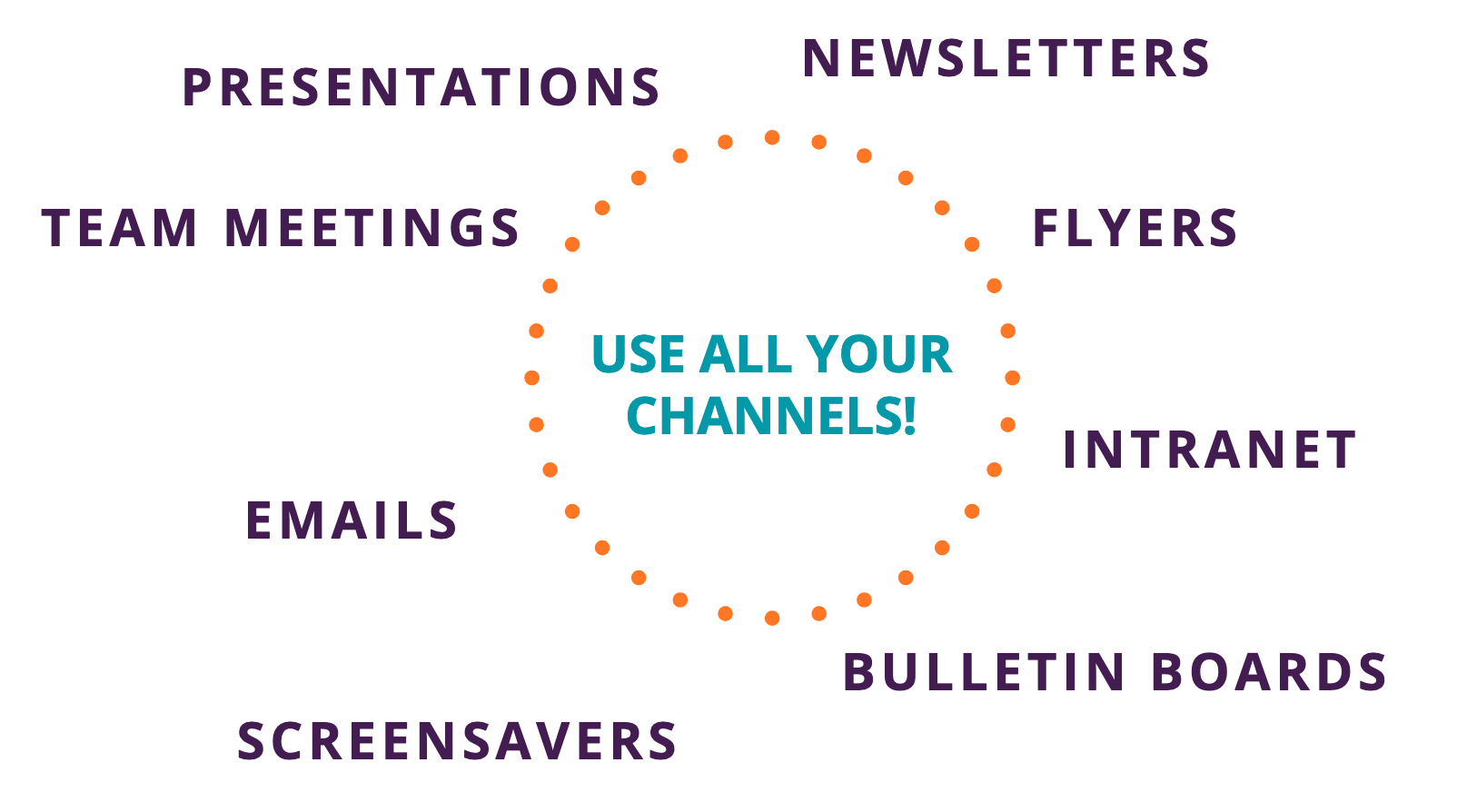

2) Promote! Tell your employees

Plan your communications to let your employees (and people who receive a company or personal pension) know that you’re offering this great new benefit. This allows them to make donations to charities of their choice directly from their pay, providing they pay tax through PAYE.

The person must tell you how much they wish to have deducted from their salary each month (after NI but before PAYE). Then they tell the payroll giving agency which charity they want to donate to.

When you sign up to an approved Payroll Giving Agency they’ll signpost you to charity nomination forms or an online system that your employees can use to choose their charity. Sometimes people want this to be confidential – you don’t need to know who they choose, and they might want to be anonymous to the charity.

If your company supports a particular charity your employees can use payroll giving to make donations to that too, but they have to always be free to give to any charity they want to. Some employers pledge to match their employees’ donations as well.

You might want to ask a charity – or a local group of charities – to come to your business and talk to people about the scheme, or you could invite a payroll giving professional fundraising organisation to do this. HMRC have a list of professional fundraising organisations.

3) Pass on the donations

You pass on all the donations you’ve deducted to your chosen Payroll Giving Agency. They then distribute the donations to your employees’ chosen charities – you don’t have to do anything else. All modern payroll systems can handle payroll giving and there aren’t any extra tax forms to fill in.

You’ll need to keep certain records if you run a payroll giving scheme, including:

- a copy of your contract with the Payroll Giving Agency

- the forms/declaration that your participating employees provide, authorising deductions

- a record of the deductions that you make from each employee’s pay

- a record of all the money you pass on to the Payroll Giving Agency

Top tips to make the most of it

- Set an internal target. Why not go for the Gold Award and aim for 10%?

- Match your employees’ donations and publicise it – it can be a powerful incentive

- Organise promotional days where your staff can find out more and sign up

- ‘Tell’ rather than ‘sell’ the scheme. Giving can be very personal, so actively promote the positives of the scheme, but don’t force it

- Recruit champions – they can be invaluable in selling it to their peers

- Put promotional material in induction packs so new staff know about it

- List payroll giving as a community investment scheme on your website

- If you can, use the intranet and emails to enable people to donate ‘at the touch of a button’

- Thank participants and celebrate their contributions – share their successes!

This was updated in March 2019 by Heart of the City. We’ve created these resources for individual SMEs to use. None of our content is to be adapted, reused or repurposed for commercial use.